- About 15 years ago, the esteemed economist Steven N.S. Cheung predicted that within a few years, the importance of China’s domestic market would surpass that of its export market. By then, even if subjected to trade sanctions by the United States, China could afford to disregard them. An important economic theory proposed by Adam Smith is that “the division of labor is limited by the extent of the market." Currently, China is the largest trading partner for over 140 countries and is the only country in the world that produces all industrial categories defined by the United Nations. This validates Adam Smith’s wisdom and also demonstrates that China’s supply-side capabilities have significantly evolved.

A large market allows for finer and more comprehensive specialization; conversely, such detailed and comprehensive division of labor can bring significant cost advantages, facilitating further market expansion. This creates a positive feedback loop. For instance, China’s new car sales in the first ten months of 2023 approached 30 million units, double that of the second-largest market, the United States. This adequately explains why Chinese electric vehicles are relatively more affordable compared to most countries worldwide and why they are sold at higher prices in Europe and America than in China.

- At the onset of the trade war initiated by the Trump administration in 2019, I predicted that this move would accelerate the industrial upgrading of China and that the United States would only incur substantial costs in vain. This is all the application of basic economic laws. Today, looking at China’s competitiveness in electric vehicles, and the United States’ continued high reliance on China for trade (whether it’s made in China or made by China, although the official data may show a slight decrease in imports from China, the significantly increased supply from Mexico or Southeast Asian countries almost always involves a high proportion of Chinese enterprises), once again proves the predictive power of economics.

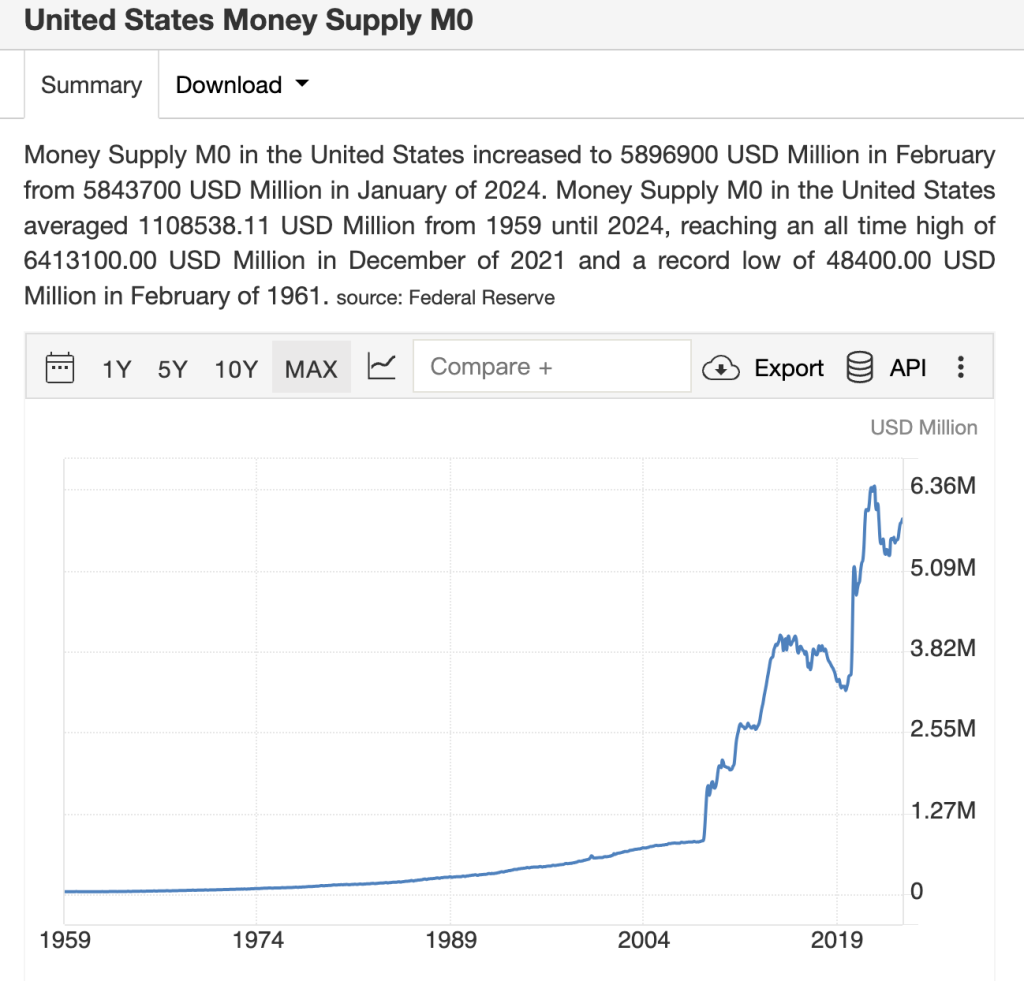

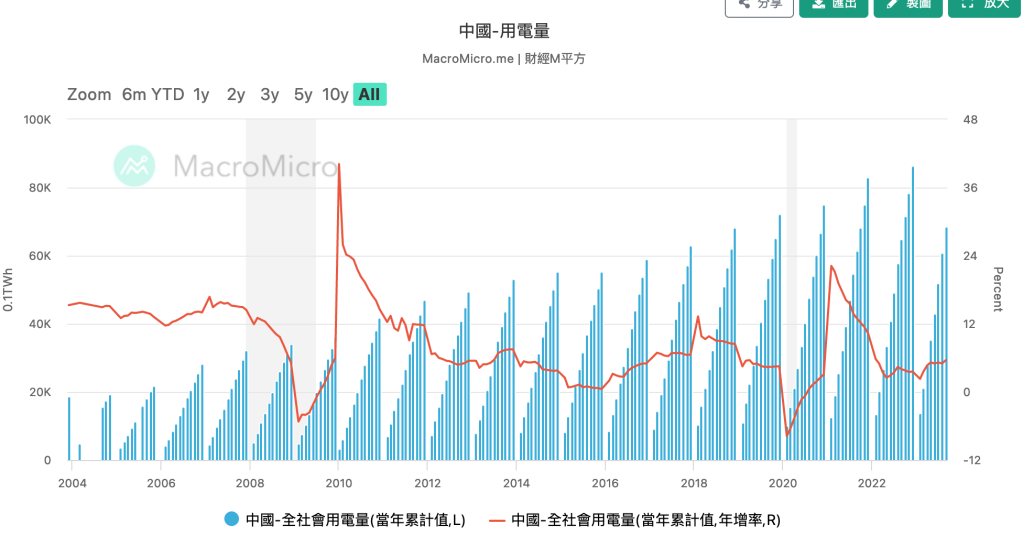

- The higher the degree of market freedom in China, the stronger its ability to cope with monetary tightening/inflation. In other words, those who widely discuss the severe risk of deflation in China are 99% economically illiterate, and their statements are not worth considering. As Steven N.S. Cheung has repeatedly mentioned in his articles over the years, China has faced severe deflation for a long time since the reform and opening-up, yet it enjoyed high economic growth during the same period. The key lies in the high degree of market freedom, where various complex contractual relationships can be rapidly changed and priced. Therefore, as long as China continues to maintain an open and free market approach, its resilience to monetary fluctuations will undoubtedly far exceed that of the relatively unfree markets in Europe and America.

Note:

Ministry of Commerce: The total retail sales of consumer goods in October reached 4.3 trillion yuan, an increase of 7.6% year-on-year

People’s Daily, Beijing, November 22 (Reporter Sun Hongli) – On November 22, a spokesperson from the Department of Consumer Promotion of the Ministry of Commerce discussed China’s consumer market situation in October 2023, stating that in October, the total retail sales of consumer goods reached 4.3 trillion yuan, an increase of 7.6% year-on-year, accelerating by 2.1 percentage points from September and rebounding for three consecutive months; from January to October, the cumulative total was 38.54 trillion yuan, an increase of 6.9% year-on-year.

The spokesperson from the Department of Consumer Promotion pointed out that in October, commercial authorities at all levels, in accordance with the overall arrangements of the “2023 Year of Consumption Promotion", seized the favorable opportunity of the National Day holiday consumption peak season, accelerated the implementation of various consumer promotion policies and measures, actively organized and carried out activities such as the Golden Autumn Shopping Festival, Home Renewal Consumption Season, and New Energy Vehicle Consumption Season, optimized the supply of consumption, innovated consumption scenarios, boosted consumer confidence, and promoted the continuous recovery and expansion of consumption.

The growth rate of commodity consumption accelerated. In October, the retail sales of goods increased by 6.5% year-on-year, accelerating by 1.9 percentage points from the previous month. Upgraded products such as outdoor sports equipment, new electronic products, new energy vehicles, and smart home appliances performed well. The retail sales of sports and entertainment goods, communication equipment, automobiles, and home appliances in above-designated-size units increased by 25.7%, 14.6%, 11.4%, and 9.6% year-on-year, respectively, accelerating by 15.0, 14.2, 8.6, and 11.9 percentage points from the previous month, respectively. The sales volume of new energy vehicles increased by 33.5% year-on-year, accounting for 33.5% of new car sales.

The growth of service consumption was relatively fast. From January to October, the retail sales of services increased by 19.0% year-on-year. Driven by the holiday effect and other factors,

service consumption demands such as accommodation and catering, cultural tourism, and transportation were released intensively. In October, catering revenue reached 480 billion yuan, an increase of 17.1% year-on-year; movie box office revenue exceeded 3.6 billion yuan, increasing by about 70%; railway passenger transport volume and urban rail transit passenger transport volume increased by 195.6% and 55.8% year-on-year, respectively.

Online retail sales performed well. From January to October, online retail sales reached 12.3 trillion yuan, an increase of 11.2% year-on-year, of which online retail sales of physical goods reached 10.3 trillion yuan, increasing by 8.4%, accounting for 26.7% of the total retail sales of consumer goods.

Physical retail continued to recover. From January to October, the retail sales of above-designated-size physical stores increased by 4.3% year-on-year, accelerating by 0.3 percentage points from January to September. Among them, retail sales of convenience stores, department stores, specialty stores, and brand stores increased by 7.3%, 7.2%, 4.7%, and 3.6% year-on-year, respectively. During the National Day holiday, the average daily passenger flow of national demonstration pedestrian streets increased by 87.4% year-on-year, and the average daily passenger flow of key business districts in 36 large and medium-sized cities increased by 1.6 times year-on-year.

Urban and rural consumption grew steadily. In October, urban consumer goods retail sales reached 3.7 trillion yuan, an increase of 7.4% year-on-year; rural consumer goods retail sales reached 585.4 billion yuan, an increase of 8.9% year-on-year. From January to October, urban and rural consumer goods retail sales reached 33.39 trillion yuan and 5.16 trillion yuan, respectively, an increase of 6.8% and 7.6% year-on-year, respectively.

(translated by ChatGPT)